Probate is the court-supervised procedure of dispersing a dead individual’s assets after their fatality. The court of probate supervises the transfer of residential or commercial property to ensure the dead person’s financial obligations are paid and their properties are transferred to individuals qualified to receive them.

Probate can be a complex, prolonged, taxing procedure. However, in situations where the dead individual’s possessions are listed below a legal limit, the estate might qualify for a simplified estate management procedure.

If you lately shed a loved one and are starting the probate process, Nevada probate lawyer Natalia Vander Laan can examine your situation to establish whether your loved one’s estate receives simplified administration. Despite the probate procedure you have to adhere to, Ms. Vander Laan can lift this worry and take care of the estate management process so you and your household can concentrate on the grieving procedure.Вы можете найти здесь более Find out more about michigan affidavit of small estate Из нашей статьи

Small Estate Probate in Nevada

A person that dies with a Will is said to have actually died ‘testate.’ Usually, their Will recognizes somebody who will work as the Estate Administrator.

A person that passes away without a Will is claimed to have actually passed away ‘intestate.’ When somebody passes away intestate, the probate court selects somebody to work as the Estate Manager.

The Estate Administrator or Estate Manager is accountable for handling the dead individual’s estate. Typically, this suggests they should open up an estate in the court of probate of the nation where the departed person passed away. They should take a supply of estate assets, pay any debts and taxes the departed person owed, and disperse the continuing to be possessions to individuals named in the departed individual’s Will certainly or individuals that are entitled to obtain the deceased person’s property under Nevada regulation’s intestacy regulations (the deceased person’s successors).

In certain circumstances, the estate may get a streamlined probate procedure. If the overall gross worth of the estate is less than $300,000, the estate might receive Summary Administration. If the estate is valued at less than $100,000, it might get Set-Aside Probate. And for estates valued at less than $25,000 (excluding the value of any lorries) that do not consist of real property, the estate agent might just require to submit a Testimony of Privilege.

Recap Management for Estates Valued at Less than $300,000

If the decedent’s estate is valued at less than $300,000, the estate representative can ask for a Summary Management of Estates. Recap administration does not avoid probate entirely, however it is a more structured process that can save time and probate costs.

The main benefits of a Summary Administration are:

- Lenders should present insurance claims versus the estate within 60 days, as opposed to 90 days in a basic administration.

- The requirement to publish a notification of the request for probate in a paper is waived.

Court Of Probate Set-Aside

For estates valued at less than $100,000, the court of probate can purchase that all or part of the estate be ‘set aside without management’ so estate assets can be distributed directly, in the adhering to order or priority:

- To pay lawyer’s charges

- To pay funeral service costs, the expenditures of a last illness, and any type of money owed to the Division of Wellness for Medicaid repayment

- To pay financial institutions

- To individuals who acquire under a Will or, if there is no will, under Nevada intestacy regulations

If the departed individual left a making it through partner or minor kids, the court will typically allot the entire estate for the partner or small youngsters without very first paying financial institutions.

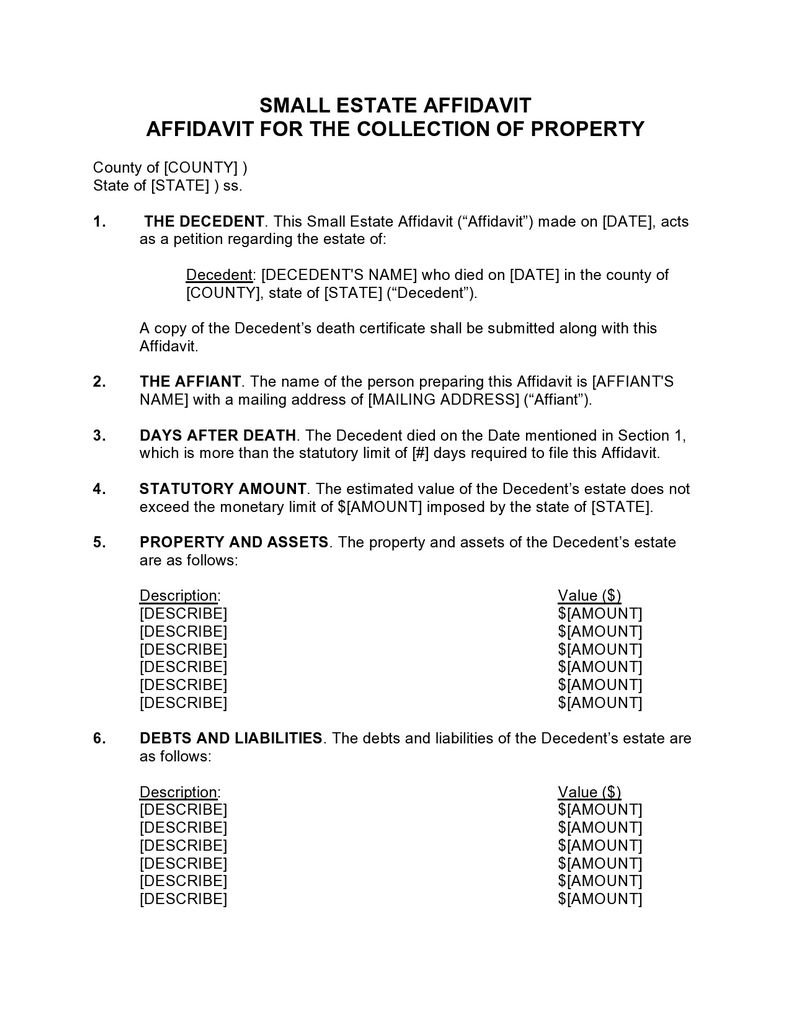

Nevada’s Small Estate Testimony

Nevada’s Small Estate Sworn statement procedure permits inheritors to skip probate altogether. To certify, the estate needs to meet the list below demands:

- The complete worth of the estate is less than $25,000 ($100,000 if the individual submitting the Small Estate Affidavit is the dead person’s surviving partner)

- The deceased individual did not very own realty

- No petition for the appointment of a personal representative is pending or has been granted in any kind of jurisdiction

- At least 40 days have passed considering that the individual’s fatality

If the estate fulfills these needs, the inheritor can file a Small Estate Affidavit. At the very least 14 days before submitting the Small Estate Testimony, the inheritor must give any other recipients with composed notice of the insurance claim and a description of the property to be transferred.

After authorizing the record and having it notarized, the inheritor presents the affidavit to the individual or organization that holds the dead person’s property, frequently with a duplicate of the death certificate. Then, the individual or organization holding the property must launch the property.

Get In Touch With The Vander Laan Law Office for Small Estate Probate in Nevada

If you need assistance with small estate probate in Nevada, Natalia Vander Laan can assist. Ms. Vander Laan is a skilled probate and estate preparation lawyer who happily serves the Carson Valley.