Beginning a service includes numerous key steps, with consolidation being one of one of the most substantial landmarks for business owners aiming to establish a formal corporate entity. One crucial piece of this process is recognizing ‘What are Articles of Incorporation?’ and the crucial duty they play in developing a company.

Declaring this record with the appropriate state authority not just develops your service as a legal entity but also establishes the foundation for its lasting procedure and trustworthiness. This guide will stroll you with everything you need to know about Articles of Consolidation, including their definition, benefits, filing process, and next steps to make sure conformity.

What are Articles of Incorporation?

The Articles of Consolidation, likewise called a Certification of Consolidation in some states, is an official lawful paper required to create a company, outlining the vital details required to legitimately develop business.

To offer the posts of incorporation meaning, these papers consist of crucial details such as the corporation’s name, function, registered representative, and the variety of shares licensed.At site virginia articles of incorporation from Our Articles

It serves as the foundation for the company’s legal presence, offering crucial information concerning business structure and procedures.

Articles of Unification definition

At its core, the Articles of Unification serve as the ‘birth certificate’ of a firm. When filed with the state, this document officially develops the firm, giving it lawful acknowledgment. Each state has its very own requirements, but the Articles typically include information such as the company’s name, purpose, and registered agent details.

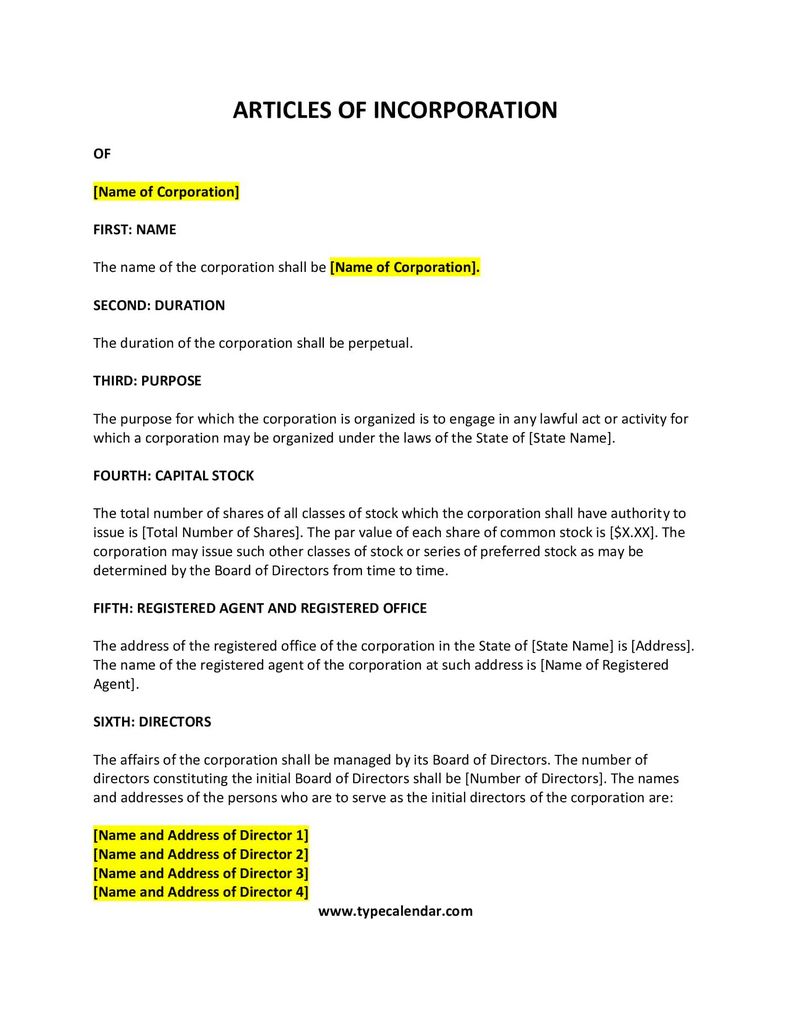

Instance of Articles of Incorporation

Below is an example of Articles of Consolidation (also described as a Certification of Consolidation in Delaware), which answers the concern ‘what do posts of unification look like’ and is a paper required by the state to develop a corporation.

This record is divided right into 6 vital areas:

- Name: Defines the main name of the company.

- Registered workplace and Registered representative: Lists the address of the corporation’s authorized office and the signed up representative accredited to obtain legal documents.

- Function: Specifies the purpose or objectives of the firm.

- Supply info: Information the authorized quantity of supply the firm can issue.

- Incorporator details: Includes the name and mailing address of the specific in charge of submitting the document.

- Signature: The undersigned area, where the incorporator officially authorizes the record.

Each section serves a critical role in legally specifying the corporation’s presence and framework.

Advantages of declaring Articles of Incorporation

Declaring Articles of Consolidation unlocks to a number of essential advantages for your company:

Personal asset defense

Among the top factors business owners incorporate is to shield their personal possessions. Declaring Articles of Unification develops a clear boundary between your personal and company obligations.

If your firm faces financial debts or legal problems, your personal property, like your home or financial savings, typically stays risk-free. This protection is very useful, specifically in industries vulnerable to dangers or suits.

Unique legal rights to service name

When you integrate, your service name is signed up with the state, guaranteeing that nothing else firm in the exact same state can use the precise same name. This gives a level of exclusivity and protects your brand identification within that jurisdiction.

Nevertheless, it is necessary to keep in mind that this security is typically limited to the state where you include. If you want more comprehensive security, such as across the country exclusivity, you may require to register your service name as a hallmark with the U.S. License and Hallmark Office (USPTO).

Prospective tax obligation benefits

Although companies are tired differently from sole proprietorships or collaborations, they can gain from details tax benefits. Depending upon the framework (such as C corporation or S firm), you may minimize overall tax obligation, maintain incomes within the business, or subtract costs like fringe benefit.

Improved organization credibility

An incorporated business lugs even more weight in the eyes of consumers, suppliers, and capitalists. The ‘Inc.’ or ‘Corp.’ at the end of your firm name signals security, professionalism, and long-term commitment. This can aid attract customers and enhance your track record in your industry.

Additionally, several companies and federal government entities prefer to collaborate with bundled services, opening doors to bigger agreements or partnerships.

What to include in the Article of Unification?

When preparing your Articles of Unification, right here’s the important information you’ll need to consist of:

- Firm’s name: The main lawful name of your business.

- Organization function: Either a general purpose or a details one customized to your procedures.

- Registered representative details: Call and deal with of the private or entity authorized to obtain legal records in behalf of your corporation.

- Preliminary supervisors: Names and addresses of the people that will oversee the firm.

- Number and sorts of shares: The number of shares the company is authorized to issue and any kind of details about their courses.

- Period of the firm: Whether the corporation is perpetual or exists for a specific term.

- Company address: The principal office address of the corporation.

- Sort of firm: For instance, C Firm or S Firm.

- Various arrangements (optional): Any kind of added information appropriate to your business operations, such as investor legal rights or electing procedures.

Exactly how to prepare Articles of Unification?

When you recognize ‘what is a short article of consolidation’, you can begin preparing one for your service. Using a state-provided layout can streamline the procedure and make certain everything is finished smoothly.

Step 1: Get your state’s design template

Most states give a standard Articles of Unification design template on their Secretary of State web site.

To discover the theme:

- See your state’s Secretary of State or company registration web site.

- Look for ‘Articles of Unification’ forms.

- Download and install the correct theme for your firm type (e.g., expert firm, nonprofit, etc).

The layout will generally include areas or areas for fundamental information like your firm’s name, address, and the name of your registered representative.

Action 2: Include customized stipulations

Customized stipulations are optional, yet they can offer clearness and secure your business rate of interests down the line. Some custom arrangements you could take into consideration adding include:

- Ballot legal rights: Define the voting civil liberties of shareholders, especially if your firm will certainly issue numerous courses of supply.

- Indemnification provision: Protect supervisors and policemans from individual liability for company actions.

- Duration clause: State how long you desire the firm to exist, whether indefinitely or for a details period.

- Constraints (if any kind of): Include conditions that limit particular tasks, such as constraints on transferring shares.

Action 3: Submit and file your record

Once your template is total and customized, it’s time to file it. The majority of states permit you to file Articles of Incorporation online, by mail, or face to face.

- Pay the filing cost: Declaring charges differ by state yet commonly range from $50 to $300.

- Preserve a duplicate: Keep a copy of the wrapped up document for your documents, as you’ll require it for tasks like opening up a business checking account or safeguarding a Company Identification Number (EIN).

When and where to file Articles of Unification?

Comprehending when and where to submit, that is accountable for dealing with the procedure, and just how much it costs can make the process seem much less intimidating.

When to file

The Articles of Consolidation are submitted throughout the preliminary phase of setting up a firm, right after selecting a business name, confirming its accessibility, and choosing a signed up representative to represent your firm.

It’s crucial to file as soon as you prepare. Waiting also lengthy to file might delay critical following steps, like opening a company bank account or acquiring an Employer Identification Number (EIN) from the IRS.

Where to submit

Articles of Consolidation are filed with the Secretary of State (or its equal) in the state where you intend to run your corporation.

Each state has its own workplace for business filings, which can usually be found on the state government’s website. Many states likewise use online filing services, making it much faster and easier to finish the procedure.

Who prepare and submit the Articles of Consolidation

The person responsible for preparing and filing Articles of Unification is called the ‘incorporator.’ This can be a company owner, a firm rep, or anyone designated to handle the documentation.

For included benefit and accuracy, you can employ the aid of a company attorney or an online unification service. Relied on companies like BBCIncorp concentrate on browsing state-specific demands and making sure error-free filings, whether you’re incorporating in Delaware or exploring offshore jurisdictions.

Declaring fees

The price to file Articles of Incorporation differs commonly by state, typically ranging from $50 to $300. Additional costs might apply if you make use of an attorney or an on the internet service to prepare and file the documents.

Some states also charge a franchise tax obligation or require an annual report after the preliminary filing, so it’s a good idea to allocate continuous conformity prices.

What occurs after submitting Articles of Unification?

Filing Articles of Consolidation is a major landmark in creating your company, yet it’s just the start of your business’s lawful and operational configuration.

After your records are sent, there are several crucial steps to finish before your company is totally functional and in compliance with state demands.

- Develop bylaws: Bylaws assist ensure your firm runs efficiently and remains compliant with state legislations. They’re also typically required by banks or capitalists during due diligence.

- Hold initial shareholder and director conferences: When you’ve drafted your company bylaws, it’s time to arrange a meeting to embrace company laws, designate officers, and make initial decisions.

- Acquire an EIN (Company Identification Number): You can get an EIN online via the IRS internet site. Authorization is usually immediate, so you can begin utilizing your EIN as soon as possible for tax and financial purposes.

- Protected organization licenses or authorizations: Examine if your company needs added licenses to run legally. and apply as soon as possible to avoid penalties or delays.

- Maintain compliance: Meet continuous state demands like yearly filings or franchise taxes.

Final thought

Composing and submitting Articles of Consolidation is an essential step towards developing a lawfully acknowledged company. These documents do not just safeguard your individual properties; they help your organization stick out with unique advantages like name exclusivity and enhanced trustworthiness.

If you’re still questioning, ‘What are Articles of Unification and why do I need them?’, bear in mind that this foundational lawful record can propel your company towards growth and success. When you prepare to take the jump, seek advice from sources like BBCIncorp to improve the procedure, saving time and effort.